By Michael Jackisch – Head of Soft Commodities Desk at BIC-BRED (Suisse) SA

Coffee is one of the main tropical commodities traded in Switzerland, but not all trade finance bank engage actively in the financing of this industry. This is due to some specificities of the commodity and its logistics.

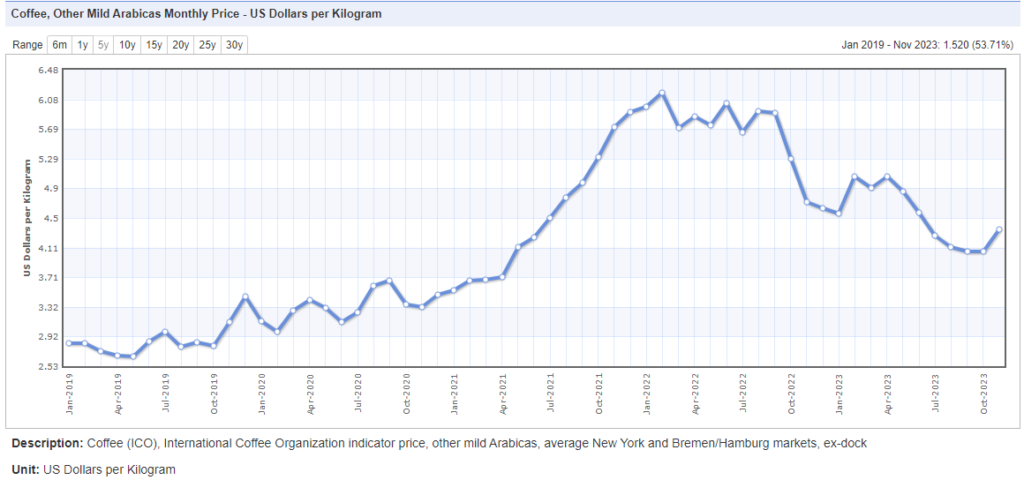

First of all, the two main varieties of green coffee (i.e. the non-roasted coffee bean), arabica and robusta, can be hedged and delivered respectively on the New-York and London futures markets. Financing banks need to be familiar and to accept to finance margin calls related to hedging price risk for the coffee they finance. A good understanding by the bank of coffee price dynamics (price volatility is high) is required, as traders and more generally the industry (incl. other financing banks) rely on the financing bank’s commitment to the sector even during market turbulences.

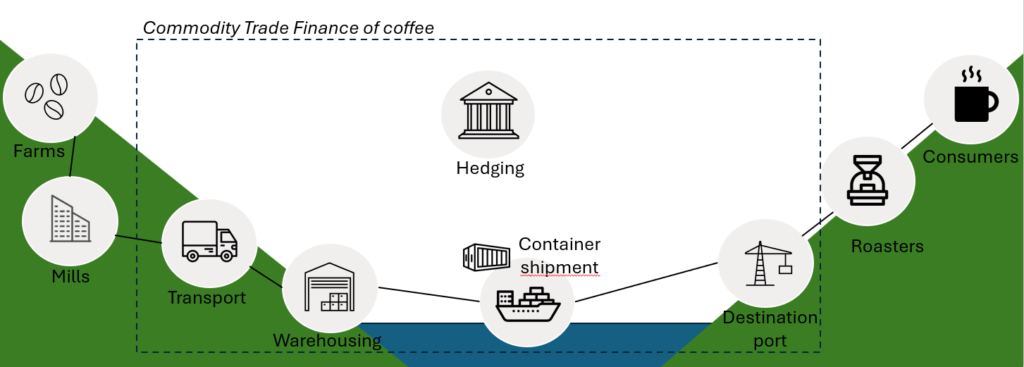

Secondly, green coffee is sold mainly in 60 kg bags and these are transported in containers rather than in larger bulk vessel. Therefore, the value of each shipment and therefore the size of each individual financing, ranges from US$ 100’000 to US$ 500’000, while financing of a shipment of grains or sugar amounts to US$ 2 million to US$ 20 million. Hence, financing of coffee is a time-consuming enterprise compared to the financing of other commodities, especially when considering the next particularity.

Thirdly, green coffee is sourced in producing countries, where some processing takes place (wet or dry milling, drying, sorting, blending, bagging…). Our financing may start up-country at the coffee mill or at any later stage, as for example during inland transit (mainly by trucks) from the mill to the load port. Coffee is also often stored at the load port until it is shipped by container to anyplace around the world. Then the coffee may be directly delivered to a buyer (usually a roaster or local trader-distributor) or may be stored, pending final sale. The financing bank needs to monitor each inland or port inventory, truck load and then each shipment of coffee it finances, as well as any further temporary inventory until a sale is realized which repays the financing.

Hence banks financing coffee merchants need to staff their front, middle and back-office teams in order to be able to monitor their risks and to be able to provide timely financing and related services (LC issuance, import/export bank collections) to the coffee trading companies they partner with.

The range of potential client includes major multinational players, medium sized and niche coffee merchants which require support from coffee origination in Africa, South and Central America and Asia up to the coffee beans reaching the roasters, through all its logistical phases. Typically, trade finance banks have to adapt the financing structure provided to each client’s needs and also to its credit profile. In doing so, BIC-BRED (Suisse) SA, for its part, always aim to adhere to the Recommended Best Practices for Commodity Finance Banks in Switzerland, that had been shared via the SUISSENÉGOCE platform in November 2021.